Myths About Current Use- Part 2

In our ongoing look at Current Use this article is a continuation in debunking myths surrounding the program (Read the first article here). To quickly review, the Use Value Appraisal program (UVA), commonly known as Current Use, is a property tax incentive that allows farm and forest landowners to have their land appraised at its “use value” as opposed to the fair market value, which would be much higher. Similar to the previous article on Current Use myths, the focus here will be on forest lands in the program even though agricultural land can be enrolled in the program as well.

Myth #6: The Current Use program costs the state of Vermont money.

Fact: The only “cost” of the program to the state is the reimbursement to local governments for the enrolled acreage. Since the program reduces property taxes for landowners, there is a decrease in the amount of property taxes that towns would be receiving if the valuation was at fair market value rate. Therefore, the state makes up the difference for local governments by

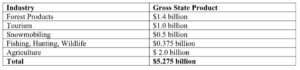

reimbursing them with funds from the State’s general fund. For example, in Fiscal Year 2010, the reimbursement was $10.7 million. While that is a large number, it is balanced out by the fact that the program creates billions of dollars in revenue for the state each year (see chart below). The revenue generated for the state by the program far outweighs the cost of the program.

Myth #7: Out-of-state landowners benefit the most program.

Fact: All landowners enrolled in the program must meet the requirements to participate, and the taxes are applied equally to all landowners enrolled. No particular group of enrollees receives special treatment. While some may believe out-of-state landowners can afford to pay more in taxes, there is no reason to test this for Current Use purposes. The goal of the program is to conserve and preserve agricultural and forest land, and maintain a working landscape. This can and should be a goal regardless if the land is owned by a local resident, a family trust, an LLC, or an incorporated business. This cannot be done if taxes are levied based on owner characteristics as opposed to land use. Regardless of where enrollees come from, the benefits of the program are experienced by all Vermonters.

Myth #8: Landowners who sell or donate their development rights and then enroll in the program are “double dipping.”

Fact: Deed restrictions, in particular conservation easements, reduce the capital costs for lands intended for long-term maintenance, conservation, or preservation. Conservation easements in combination with Current Use help toward the goals of ensuring that agriculture and forest lands stay in production for the long term. Since the program lowers costs and taxes, this can be misinterpreted as “double dipping” and landowners not paying their fair share. However, conservation easements simply prevent lands from being developed. A deed should actually lower the assessed value of the land, but few towns reduce the assessed value for conserved lands. Therefore, enrolling the land in the Current Use program is needed in order for the land to be assessed at use value. The conservation easement removes development on the land, but entering the Current Use program is often necessary to lower the taxes to an affordable level.

Myth #9: Current Use is a tax dodge for developers “parking & flipping” land. Fact: “Parking & Flipping” refers to the practice of developers purchasing land to develop in some form and then selling it at a profit. If this were the case, entering land into the Current Use program would enable developers who have no intention of being in the program long-term to have lower taxes on the purchased land before they eventually sell the property. However, Current Use has measures in place that disincentivize these kinds of actions. Landowners are subject to the Land Use Change Tax when they develop their land as a penalty for not abiding by their forest management plan and program guidelines. This has been shown to disincentivize temporary enrollment when the landowner intends to develop the entire parcel. Data has also shown that the number of enrollees that withdraw from the program is very small meaning the practice may not be very prevalent.

Missed the last article in the series? Click here to read some basic facts about maintaining enrollment in Current Use. Or click here to the first article about myths of the program.

Stay tuned for the next installment in this series, where our focus will be on foresters and their workload related to clients on Current Use. In the meantime, check these links for more information:

https://www.vermontwoodlands.org/guide-to-current-use/

https://www.vermontwoodlands.org/wp- content/uploads/2021/03/ConsultingForestersDirectory_2020VWA.pdf

https://vnrc.org/community-planning-toolbox/tools/current-use-taxation/

https://fpr.vermont.gov/UseValueAppraisal

https://tax.vermont.gov/property-owners/current-use